Bollinger Bands When Trading Forex

The Bollinger bands can provide an easy framework for price trend verification and trading signal generation.

Bollinger Bands at a Glance

- Name: Bollinger Bands

- Usage: Determines Price Volatility / Evaluates Trend / Generates Trading Signals

- Timeframes: Trading from 1 minute to 1-Hour charts (Applied best on 1-Hour Chart)

- Standard Settings: (20,2)

- Crucial Levels: When the price crosses above or below the two main bands

The Bollinger Bands developed by John Bollinger is a technical analysis tool for measuring price volatility, evaluating price trend and generating trading signals, all in a fully visualized approach.

Bollinger Bands Explained

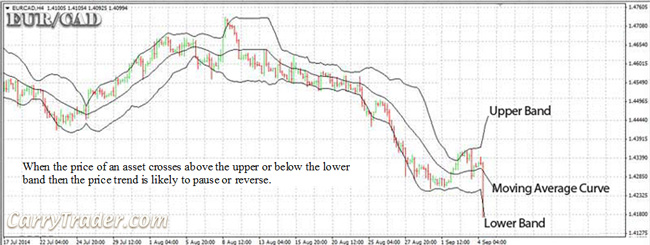

The tool is usually used by day-traders and works best when it is applied in 1-hour charts. The Bollinger bands can be used for trading any financial market or asset and can generate tens of daily signals (standard settings 20,2). When the price of an asset crosses above the upper or below the lower band then the price trend is likely to pause or reverse. The Bollinger Bands offer also traders a quick map of price volatility.

The tool consist 3 parts, two bands and a curve:

(1) Upper Band (standard deviation)

(2) Lower Band (standard deviation)

(3) Middle Curve (moving average line)

The two bands (upper and lower) represent the readings of a standard deviation and therefore consists a statistical measure. The middle curve is a moving average (in standard settings it is a 20-period moving average). In general, when the price of an asset moves outside outer bands (higher or lower) then it will likely retrace back to at least to reach the central Bollinger Curve.

Reading and Evaluating the Bollinger Bands

Bollinger Bands can provide a series of interpretations regarding the technical behavior of a trading asset:

(1) The shape of the channel indicates the price volatility. When the bands' channel is wide then the price of the asset is trading very volatile. On the other hand, when the channel is narrow then volatility is limited and most probably the price is moving sideways without a particular direction.

(2) When the price of a financial asset reaches either the upper or lower Bollinger band then it is a general signal of price reversal. If the price reaches the upper band it is a selling signal. When the price reaches the lower band then it is a buy signal.

(3) The direction of the Bollinger Bands can also indicate the price trend. The Bollinger bands can either move tilted up, tilted down or move sideways. The 2-bands shape direction is a general indication of the price trend.

Calculating Bollinger Bands

The two bands are two standard deviations and the middle curve is a moving average:

■ Upper Bollinger Band = 20-period Simple Moving Average + (20-period Standard Deviation of Price x 2)

■ Middle Bollinger Band = 20-period Simple Moving Average

■ Lower Bollinger Band = 20-period Simple Moving Average - (20- period Standard Deviation of Price x 2)

Technical Behavior

Understanding the technical behavior of the Bollinger Bands is relatively easy:

■ When the price of an asset moves below the lower Band then it is a buying signal

■ When the price of an asset moves above the upper Band then it is a selling signal

■ When the range between the two bands widens then the price volatility increases

■ When the range between the two bands is narrow then the price volatility decreases

Important Notes

-Bollinger Bands can help traders evaluate the quality of the trend and provide trading signals

-The Bollinger bands can be applied best on 1-Hour Chart

-Using the Bollinger Bands you can analyze the trend and the volatility of any market or asset (Forex, Commodities, Stocks, and Indices)

-The standard settings involve 20 periods. If the number of periods increases then the Bollinger Bands shall generate fewer but more reliable trading signals.

-Along with the standard settings, Bollinger Bands (20,2) traders can apply an additional Bollinger Band with the higher deviation (for example 45 periods). If the price of an asset crosses the first band (20 periods) and touches even ones the additional band (45 periods) then this could be a signal of a strong price reversal.

Related Links: ► Bollinger Bands Online Tool | ► Bollinger Bands at Bloomberg

MORE ON CARRYTRADER » RSI

■ COMPARE PROVIDERS

► Brokers for Carry Traders

■ INDICATORS

» MACD

» Parabolic SAR

» Ichimoku

» Pivot Points

■ TUTORIALS

» Trading with the Bollinger Bands

■ CURRENCY PAIRS

» EURUSD

» GBPUSD

» USDJPY

» EURGBP

» AUDUSD

» NZDUSD

» USDCAD

■ Bollinger Bands and Forex Trading

CarryTrader.com